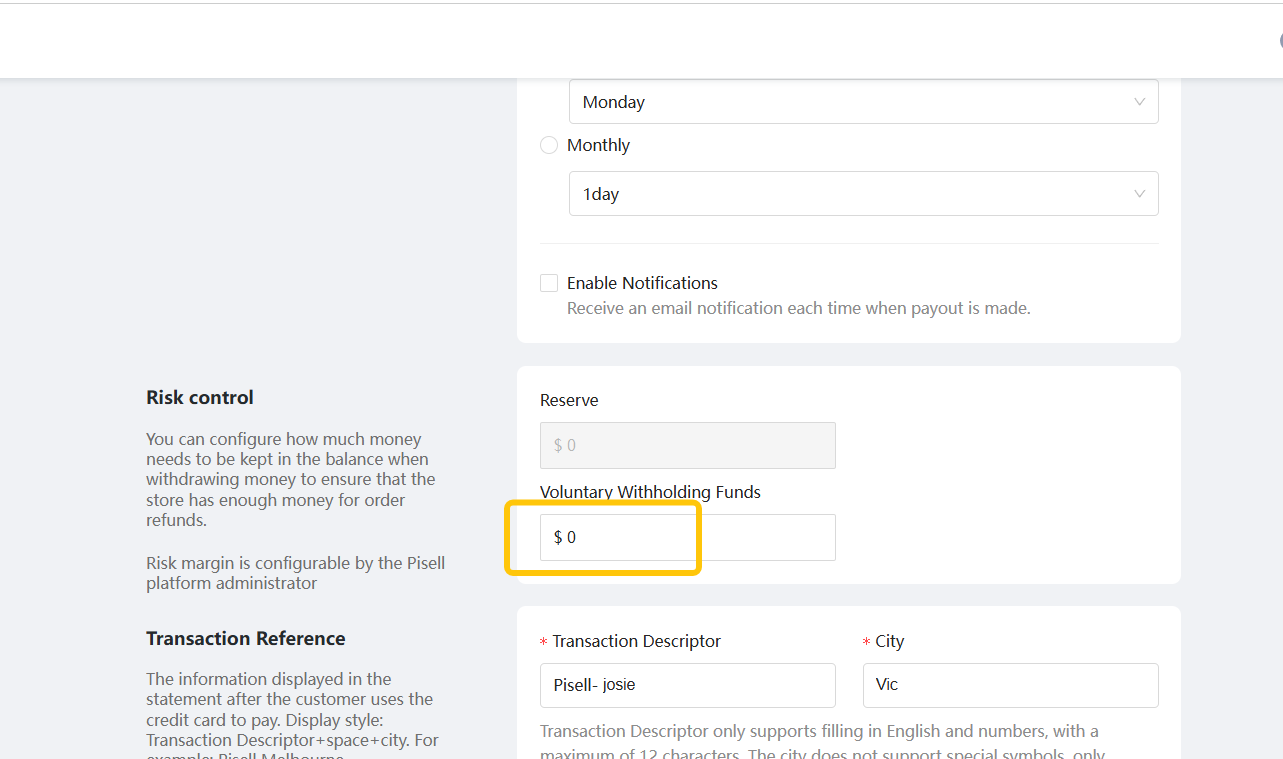

Voluntary Withholding Funds

Pisell Payment

By reserving a balance “available for refunds” before settlement, merchants can ensure that refunds are processed at any time and avoid fluctuations caused by last-minute deductions on settlement day.

This feature only affects the settlement sequence. It does not change your transaction rates and does not impact front-end payments.

Applicable to: Pisell Payments merchants.

1. Enable & Configure

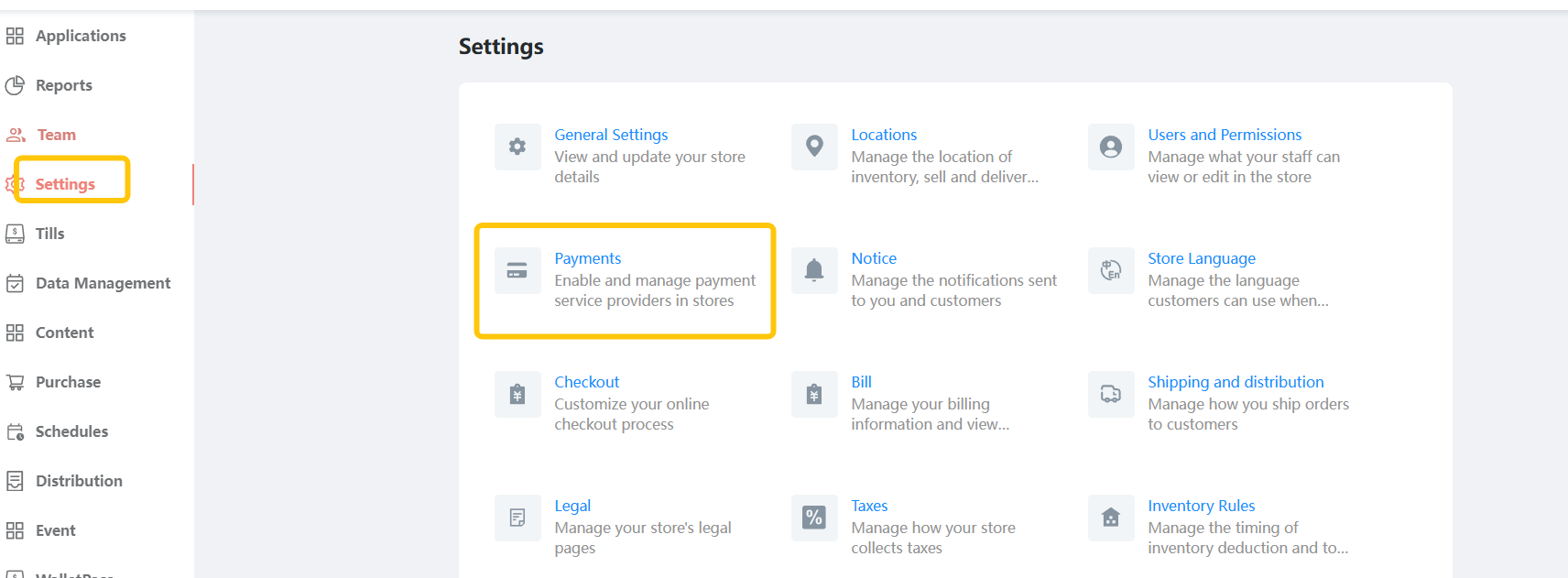

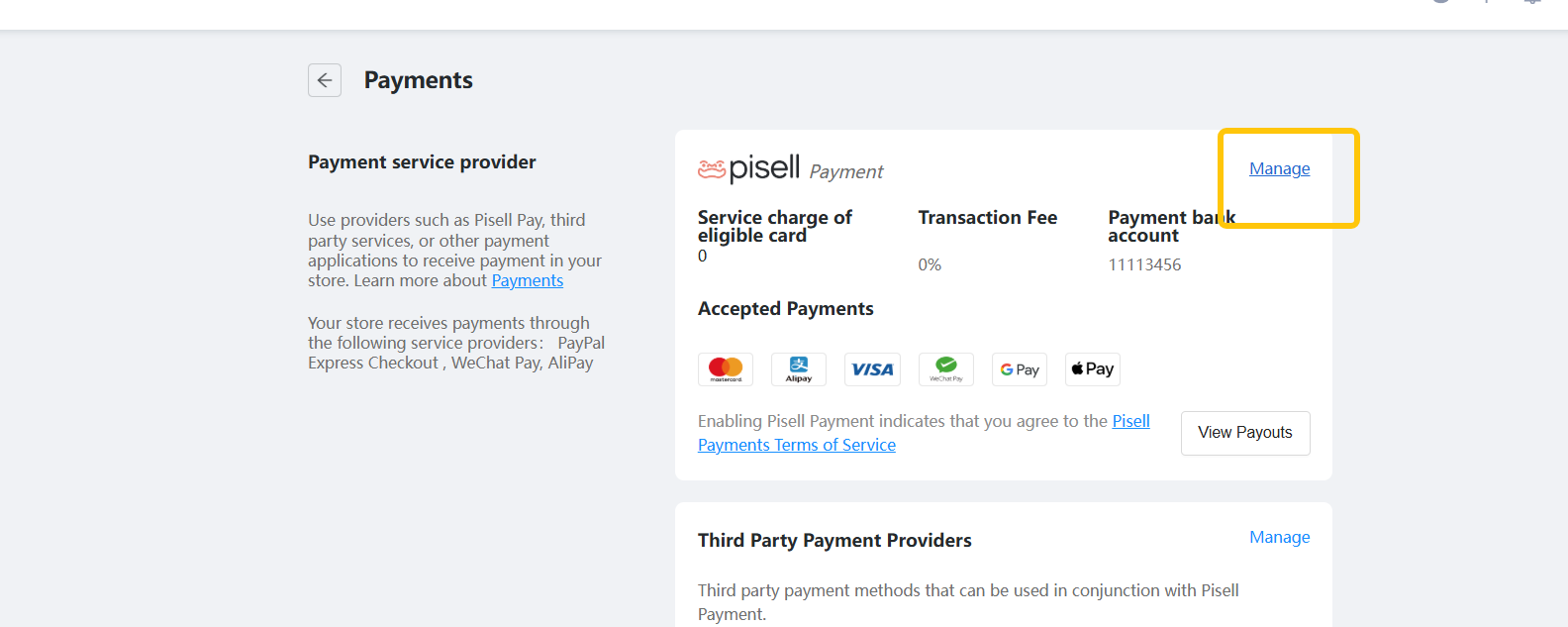

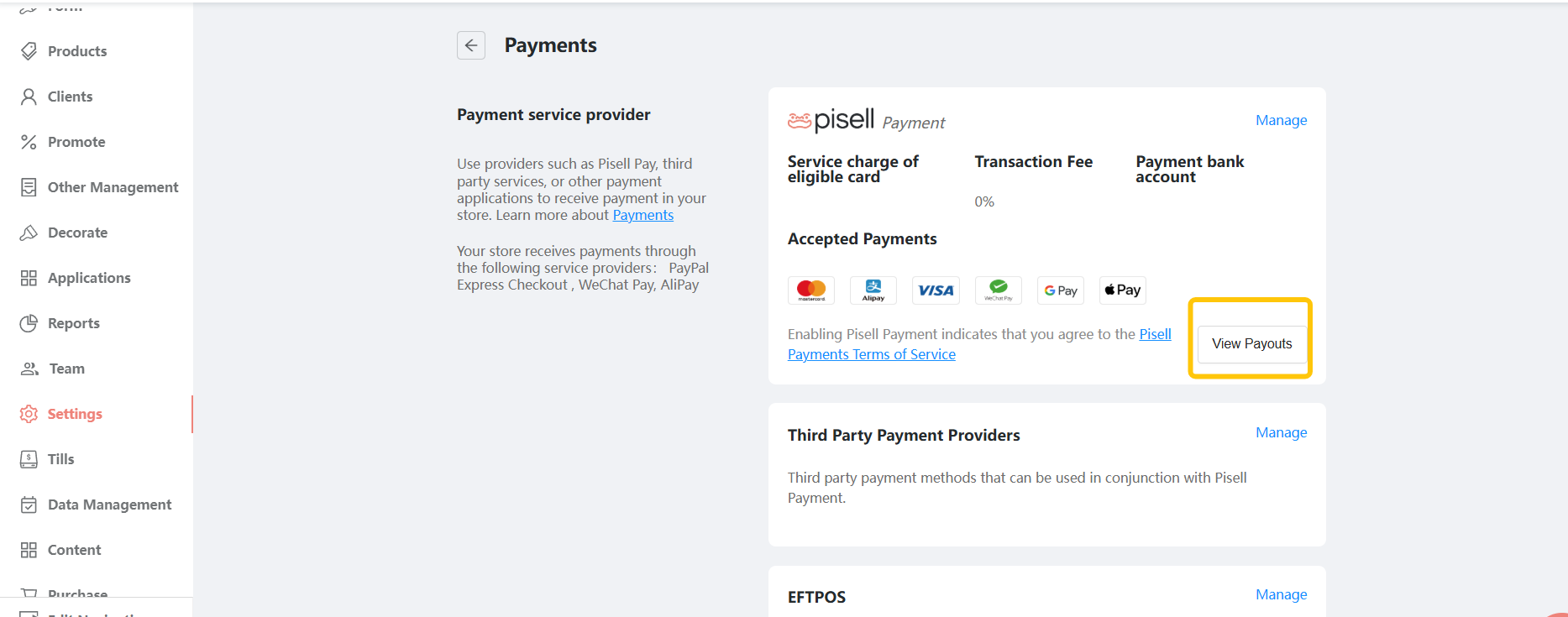

Path: Merchant Dashboard → Settings → Payments → Pisell Payment Management → Refund Reserve

Permission: Merchant administrators/finance roles with payment configuration rights.

Steps:

1. On the configuration page, enable Refund Reserve and set a target amount (choose from presets or enter a custom amount).

2. Click Save. The setting takes effect from the next settlement cycle.

3. To make changes later, simply adjust the target amount:

-

-

Increase: The system will gradually top up the reserve in subsequent settlements until the new target is reached.

-

Decrease/Disable: Any excess amount will be automatically released to the settlement balance in the next cycle.

-

Notes:

1.The default Refund Reserve is 0.00, and merchants may adjust it.

2.Only whole numbers in multiples of 10 are allowed.

3.The reserved amount directly affects the actual payout amount in each settlement bill for the store.

2. Settlement & Fund Logic (Important to Know)

1. Top-up first

-

At each settlement (e.g., T+1), the system checks the “current reserve balance vs target amount.”

-

If under target → the reserve is topped up first from the settlement amount.

-

If on target → settlement proceeds as normal.

2. Priority with Risk Reserve

-

If both the "Risk Deposit" and the "Withdrawal Reserve" exist, the system will first replenish the Risk Deposit, then the Withdrawal Reserve, and only afterward settle the remaining amount to the merchant’s settlement account.

-

The Risk Reserve is determined by risk control as a safety buffer, while the Refund Reserve is self-set for refund purposes.

3. Refund/Chargeback deduction order

-

Refunds are first deducted from the available account balance.

-

If insufficient, funds will be drawn from the Refund Reserve.

-

Used amounts are automatically replenished in subsequent settlements until the target is restored.

4. Release rules

-

When lowering the target or disabling the feature, excess funds are released in the next cycle.

-

Amounts already used for refunds will not be rolled back.

5. Examples

Example A: Initial target set at 1,000 AUD

- Cycle 1: Settlement = 600 → Entire 600 goes into reserve (600/1,000 reached) → Payout = 0

- Cycle 2: Settlement = 1,200 → 400 topped up to reach 1,000 → Payout = 800

- Cycle 3: Refund = 200 → Reserve drops to 800; next cycle will replenish back to 1,000

Example B: Target reduced from 1,000 AUD to 700 AUD

- On the day of adjustment: no release

- Next cycle: 300 released to payout balance

3. Monitoring & Reconciliation

-

Fund Overview / Settlement Page: View summary of “current balance, topped-up/released/used amounts.”

-

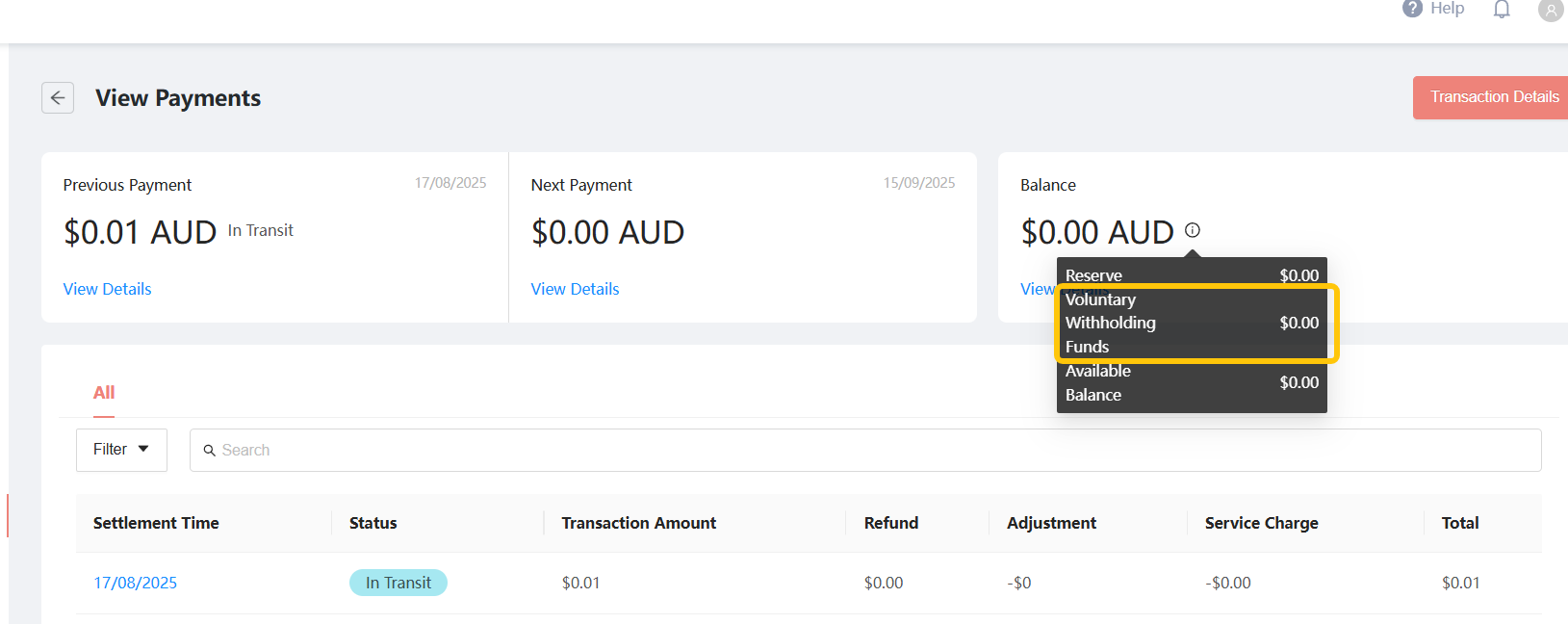

Transaction Details: Merchant Dashboard → Settings → Payments → Pisell Payment → View Payment Info → check the “Refund Reserve” field to view the available reserve balance.

Only refunds initiated through Pisell Payments are supported. Third-party or offline refunds do not affect the Refund Reserve.

- Usage records:

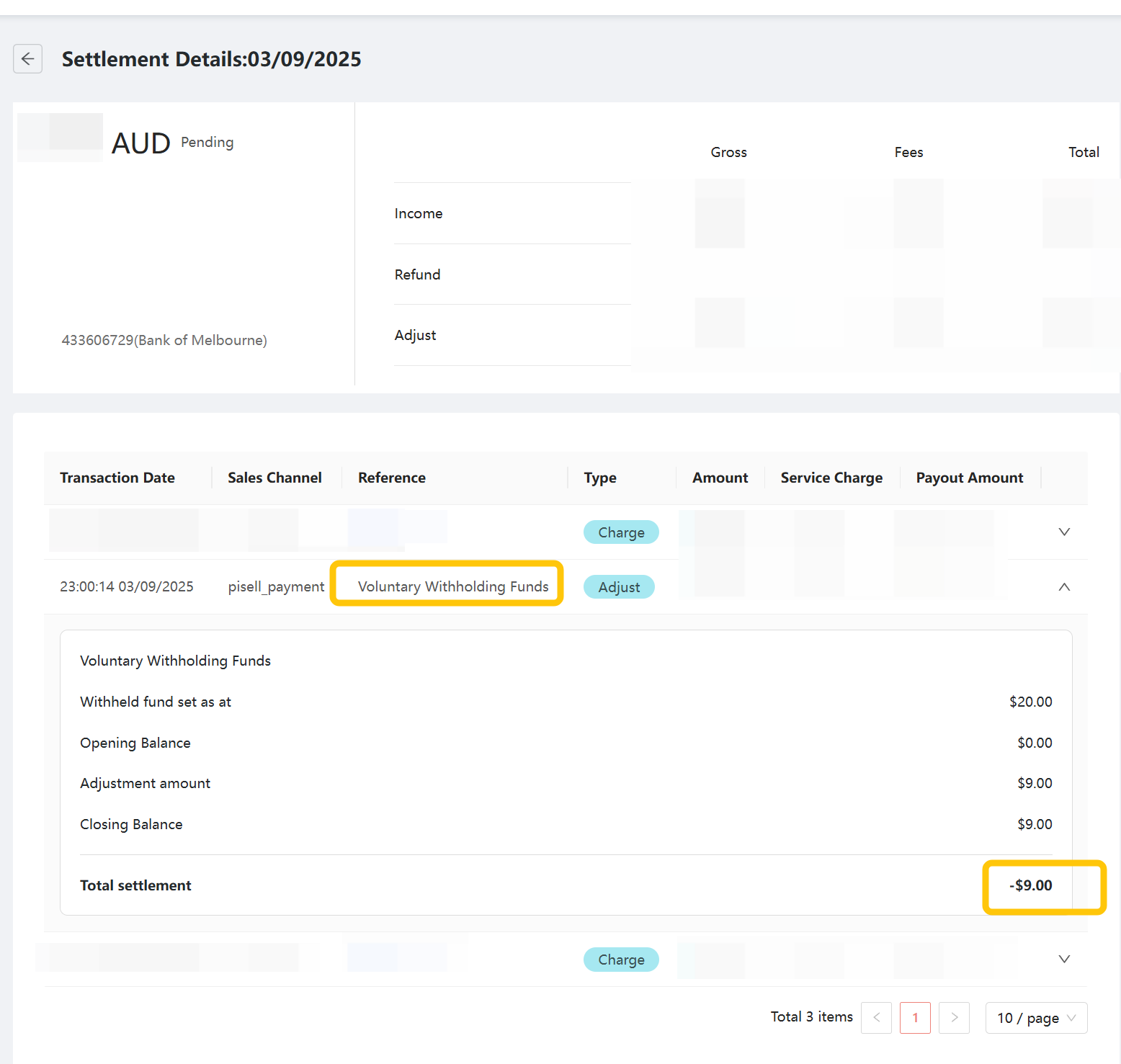

In settlement details (see Figure 1), merchants can view refund-related deductions.

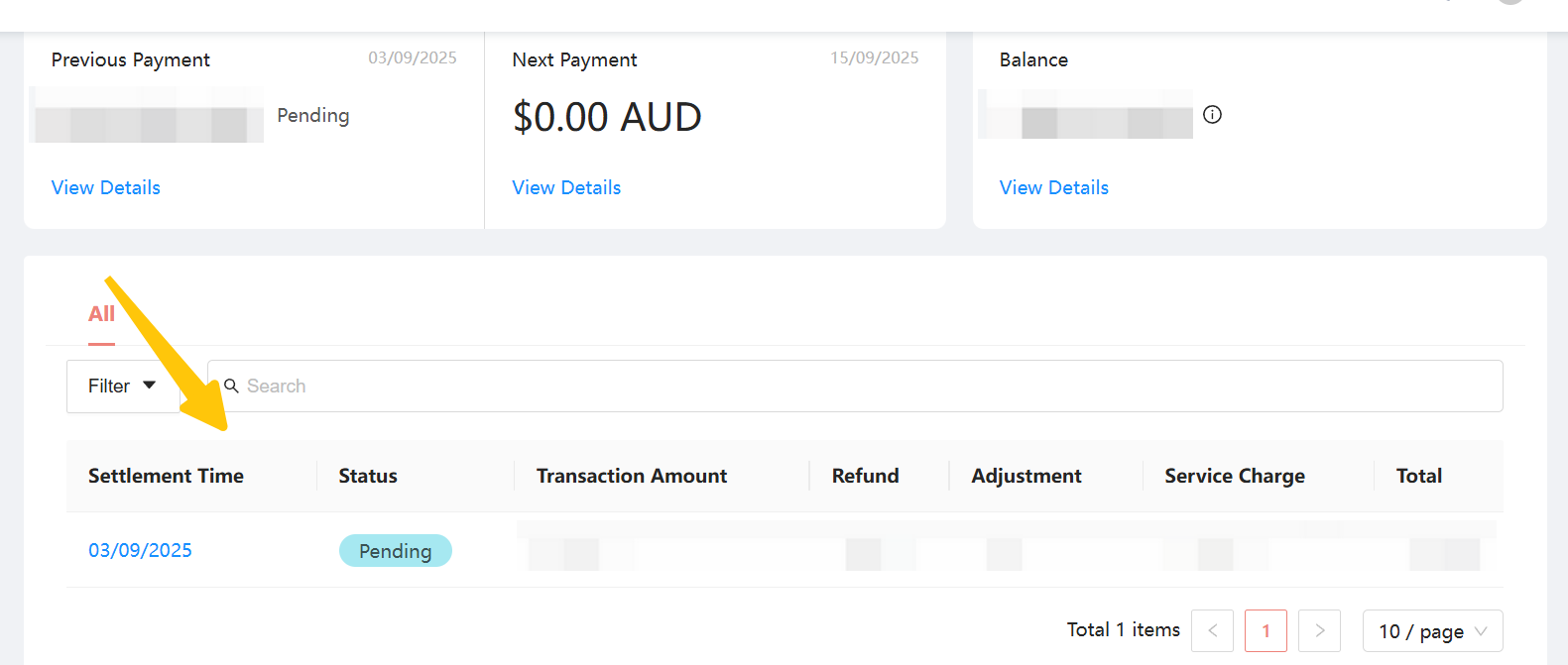

In settlement details (see Figure 2), if 9 AUD was used from the reserve for a refund, the system will replenish the same 9 AUD.

Figure 1

Figure 2

4. Configuration Recommendations (Quick Start)

-

New merchants: Start with 200–500 AUD; adjust after 1–2 weeks based on refund volume.

-

Merchants with history: Use the past 30-day total refunds × 1.2–1.5 as a target for optimal balance.

-

High-variance industries (e.g., food delivery, digital goods, membership top-ups): Consider setting a higher reserve.

5. Frequently Asked Questions (FAQ)

1. Why is today’s “settlement amount = 0”?

Because the settlement was used to top up the reserve (or risk reserve first if applicable). Once the reserve target is reached, settlements return to normal.

2. How soon do changes take effect?

From the next settlement cycle; Increases require gradual top-up; decreases release the excess in the next cycle.

3. Can the reserve be withdrawn or manually transferred?

No. The reserve is strictly for refunds and related fees. To release funds, lower the target or disable the feature, and the excess will be released in the next cycle.

4. Difference from the Risk Reserve?

The Risk Reserve is determined by the system’s risk control and serves as a risk buffer, while the Withdrawal Retention is set by the merchant to ensure refund timeliness. The priority order is: Risk Reserve → Withdrawal Retention → Settled Funds.

5. What if a refund fails due to insufficient funds?

You may temporarily increase the target, or wait for the next settlement to top up. If the issue persists, contact support for assistance.

6. What refunds are supported?

Only refunds processed through Pisell Payments. Offline/manual refunds are not included in the reserve.

6. Related Topics

751

751Family Restaurant Operation Guide - Terminal F&B System

847

847Apple Pay Platform Web Merchant Terms and Conditions

954

954Family-Friendly Restaurant User Guide (Operational Items) - Client-Side Booking for Parties and Tickets

714

714Kids Cafe Usage Guide (Operational Items) - Terminal Selling Tickets

779

779Family-Friendly Restaurant User Guide - Terminal for Booking Parties

![[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support [Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support](https://file.mypisell.com/pisel/image/435/d7d250eb99c80ca34e3e7fc75c5b92cd2025_09_26_18_07_00_009_03613999964__2880_2112__.jpeg?x-oss-process=image/format,jpg/interlace,1,image/resize,w_1080/quality,Q_90/sharpen,90) 1671

1671[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support

2163

2163Guidelines for Estimating Reserve (Merchant Self-Assessment Version)

2047

2047Voluntary Withholding Funds & Reserve Explanation

1929

1929Voluntary Withholding Funds

2165

2165Online Payment 3DS Security Upgrade

2230

2230Kids Playground Owners Beware: Your Payment System Might Be Charging You 3x More Than You Think

4180

4180Manage Your Pisell Subscription

4062

4062Pisell Payment Chargeback FAQ

4558

4558Pisell Terminal Connecting to Cash Box

4419

4419