Kids Playground Owners Beware: Your Payment System Might Be Charging You 3x More Than You Think

1. The Payment Fee Trap: That 0.9% Rate Is Just the Tip of the Iceberg

When evaluating playground or indoor playground POS systems, many business owners focus solely on the subscription cost—say, around AUD 600/month for systems like ROXXXX. But there's a much bigger, profit-draining trap that often gets overlooked:

👉 Payment Processing Fees.

These fees are more complex—and expensive—than they appear on the surface. Let's break it down using ROXXXX as a real-world example.

2. What’s Really Inside ROXXXX’s Official Payment Terms?

From a sample contract used by merchants signing with ROXXXX:

- Transaction Fee: A$0.23 per transaction

- Processing Fee (Visa/Mastercard): 0.90%

- Amex Fee: 3.95%

- “ROXXXX Payments processing fees include fixed transaction, processing, acquiring, and other costs (e.g., chargebacks, refunds, smart dunning...)”

On paper, these numbers might seem fair—but they don’t tell the full story. The real costs are buried deeper in their official website under the explanation of Interchange++ Pricing:

3. Interchange++ Pricing: The Hidden Charges You Didn’t Expect

According to ROXXXX:

“Network Fees are pass-through charges made up of a combination of interchange fees and scheme fees that are incurred and charged by banks, card issuers, and financial institutions...

ROXXXX Payments operates on an Interchange++ pricing model, meaning the applicable network fees are passed on in full."

In plain English:

- The 0.9% is just ROXXXX’s "processing markup";

- The true Visa card cost = Fixed fee ($0.25) + ROXXXX markup (0.9%) + Interchange fee (~0.3-1.0%) + Scheme fee (~0.3%–0.6%);

💥 Total effective rate: often between 2.5% – 3.0%, or even higher.

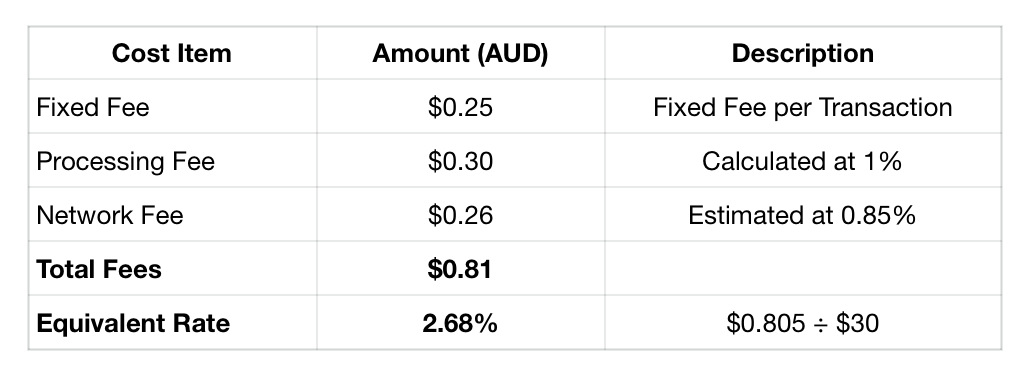

4. Real Visa Transaction Fee Example: Nearly 3% Per Swipe

The actual cost per transaction adds up fast—especially when your business processes thousands of payments monthly.

5. Booking Fees: The Extra Fee You Probably Didn’t Notice

If you enable ROXXXX's online booking or party reservation features, you'll also be charged an additional Booking Fee:

"Booking Fees may range from 2.5%–4% per online order. You may either pass this fee to guests or absorb it yourself.”

That means:

- You can charge the customer, risking conversion rates.

- Or you pay the fee yourself, losing margin on every online booking.

Either way, it eats into your profits.

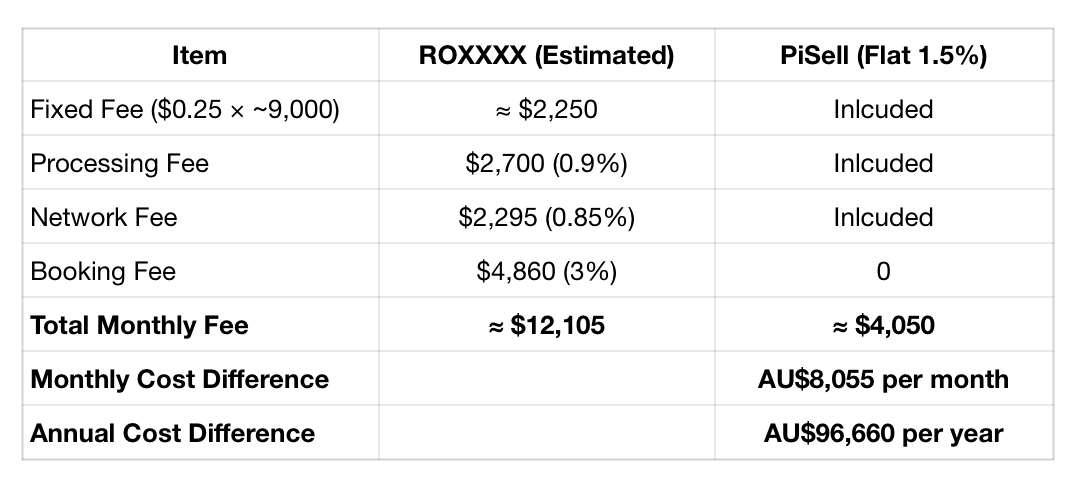

6. Real Cost Analysis: How Much Could You Be Losing Annually?

Let’s take a real-world indoor playground doing A$300,000 monthly revenue:

90% via cards = A$270,000

- 60% through booking systems

- 40% through on-site POS

Estimate effective fees at 2.5%–3%

Transaction Fee Estimation

💸 Estimated annual overcharge = A$80,000–A$100,000+

That’s one full-time store manager’s salary—gone in fees.

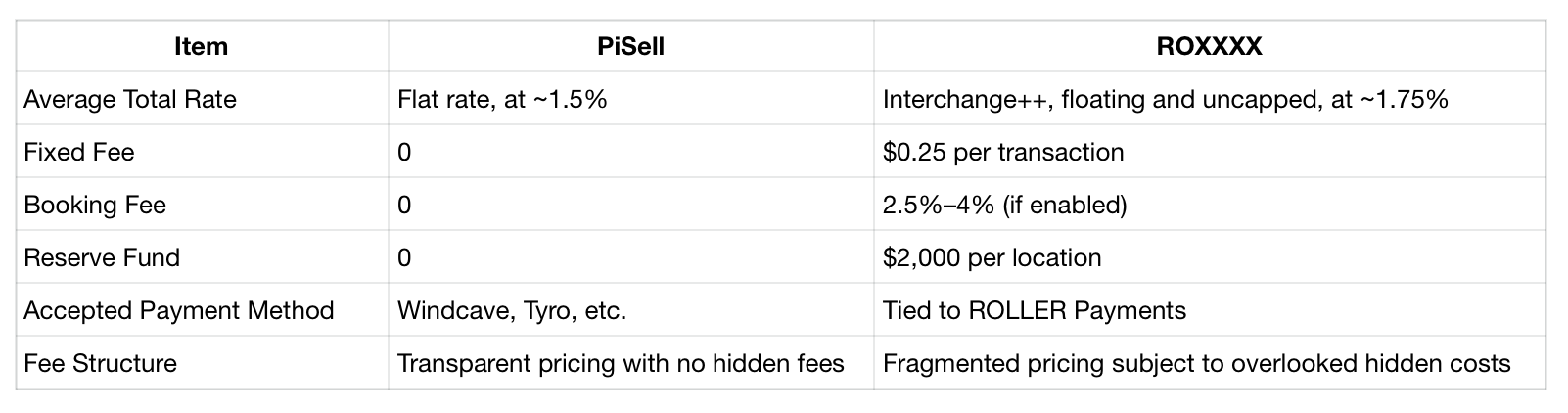

7. Transparent Fees: How PiSell Saves You More

We did a full side-by-side comparison between:

✅ PiSell’s Flat-Rate EFTPOS Model vs. ❌ ROXXXX’s Interchange++ + Booking Fee Model

With PiSell, you get:

- Transparent flat rates

- No surprise network or scheme charges

- No booking surcharges

8. Key Takeaway: Don't Let Fees Eat Your Profits

Most business owners only compare monthly software subscriptions.

But transaction fees are where the real money gets lost.

At PiSell, we offer more than just a full-featured POS system—we give you back control of your margins with transparent, flat-rate payment processing.

9. FAQ

Q1: What is Interchange++ Pricing?

A: It’s a billing model where the merchant pays the full costs passed through by banks and card issuers, with an added markup from the provider. It leads to unpredictable and higher costs—not ideal for small or mid-sized businesses.

Q2: What is Flat-Rate Pricing?

A: A flat-rate model bundles all fees into one predictable rate (e.g., 1.5%), allowing for accurate cost planning and easier profit control. PiSell uses this model to help playground owners keep costs low and margins high.

🎯Want to Know What You’re Really Paying?

📞Contact us now for a free Payment Fee Audit of your current system—or book a demo of PiSell’s All-in-One Playground Solution and take back control of your profit margins.

493

493Family Restaurant Operation Guide - Terminal F&B System

623

623Apple Pay Platform Web Merchant Terms and Conditions

715

715Family-Friendly Restaurant User Guide (Operational Items) - Client-Side Booking for Parties and Tickets

489

489Kids Cafe Usage Guide (Operational Items) - Terminal Selling Tickets

614

614Family-Friendly Restaurant User Guide - Terminal for Booking Parties

![[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support [Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support](https://file.mypisell.com/pisel/image/435/d7d250eb99c80ca34e3e7fc75c5b92cd2025_09_26_18_07_00_009_03613999964__2880_2112__.jpeg?x-oss-process=image/format,jpg/interlace,1,image/resize,w_1080/quality,Q_90/sharpen,90) 1490

1490[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support

1965

1965Guidelines for Estimating Reserve (Merchant Self-Assessment Version)

1830

1830Voluntary Withholding Funds & Reserve Explanation

1719

1719Voluntary Withholding Funds

1947

1947Online Payment 3DS Security Upgrade

2088

2088Kids Playground Owners Beware: Your Payment System Might Be Charging You 3x More Than You Think

3956

3956Manage Your Pisell Subscription

3882

3882Pisell Payment Chargeback FAQ

4400

4400Pisell Terminal Connecting to Cash Box

4255

4255