Voluntary Withholding Funds & Reserve Explanation

Pisell Payment

This article is intended for merchants who have activated Pisell Payments. It explains the purpose, triggers, setup, usage, and release mechanisms of both Risk Reserve and Withdrawal Reserve. Please read and keep this guide for reference—it will help reduce communication costs and avoid misunderstandings caused by “lack of clarity about the rules.”

Actual execution is subject to the Terms of Service, Pisell Acceptable Use Policy, Privacy Policy, Pisell Cookie Policy, and any subsequent written notifications we provide.

1. What is a Risk Reserve?

-

Nature: A risk mitigation tool designed to cover potential losses such as chargeback, abnormal refunds, or compliance penalties. It is not a penalty or additional fee.

-

Applicable merchants: All merchants may be subject to a risk reserve, but the percentage and duration will vary depending on their risk profile.

-

Fund Ownership: The Risk Reserve is essentially a settlement retention line, which is the minimum withdrawable balance retained in your Pisell account according to the rules. The funds always belong to you; they are not fees, will not be deducted as fees, and are not a prepayment for chargeback. When risk control is triggered, the minimum withdrawable settlement amount will be adjusted accordingly. Once the settlement meets the minimum withdrawable amount for the day, the remaining funds can be withdrawn. The target amount is dynamically adjusted based on actual risk, and when the risk assessment reaches 0, the corresponding minimum withdrawable amount will be lowered. Pisell only sets, holds, and releases this retention according to the rules, without changing the ownership of the funds.

1. Why is a Risk Reserve necessary?

The payments industry carries inherent, uncontrollable risks such as chargeback fraud, false refunds, insufficient logistics evidence, or irregularities in merchant information.

The purpose of the Risk Reserve is to cover potential losses immediately when risks occur, while ensuring that the overall settlement process and platform operations remain secure and compliant.

2. Factors That May Influence the Risk Reserve (Examples)

The comprehensive assessment considers, but is not limited to, the following dimensions:

- Business scope and product categories (e.g., whether involving top-ups, recharges, virtual goods, or stored-value products, which are considered high-risk).

- Order sources (offline, online, third-party platforms) and delivery methods (in-store, delivery, or postal).

- Transaction patterns such as single high-value transactions, small-value high frequency, or large-value high frequency.

- Average transaction value, daily/monthly order volume, and transaction amounts.

- Refund/chargeback ratios and historical chargeback records.

- Consistency of account/merchant identity, completeness of invoices and logistics evidence, as well as complaints and compliance review results.

These factors determine whether a Risk Reserve is required, as well as its ratio and duration. High-risk categories generally correspond to higher reserve ratios or longer holding periods.

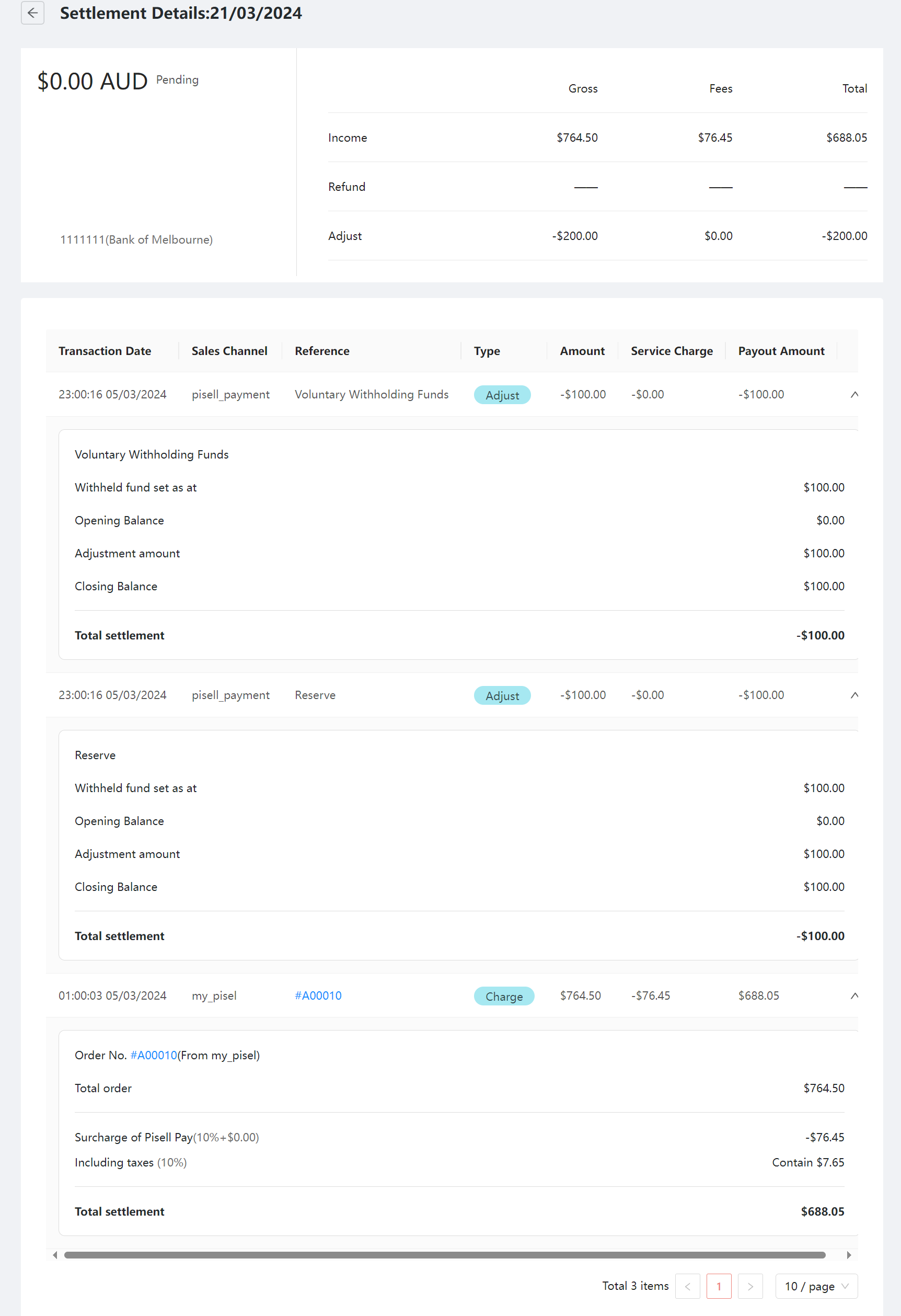

3. Triggers and Establishment (How We Implement It)

- Provide written notice (via email or in-app message) specifying the effective date, target amount/percentage, applicable duration, and release conditions.

- Source of funds & sequence: The reserve will first be allocated from pending settlement funds. If the current cycle is insufficient, the system will automatically top up the reserve in subsequent settlements until the target amount/percentage is reached.

- Settlement adjustments: In certain cases, settlement for the current cycle may be temporarily delayed or subject to a temporary limit (as part of risk protection measures). Once verification is complete, normal settlement will promptly resume.

- Collaboration and communication: You may provide input on fund arrangements. We will jointly assess and respond with an executable timeline and plan.

For prohibited transactions (e.g., virtual goods as outlined in the Terms), once verified, Pisell will suspend payments and withdrawals in accordance with the Terms, and any established Risk Reserve will be handled accordingly. If you wish to continue receiving payments, we recommend switching to a third-party channel (e.g., Stripe).

4. Release Mechanism

- Release Conditions: The reserve will be released once the period and criteria specified in the written notice are met (e.g., no new irregularities, chargeback/refund ratios fall below the threshold, required documentation verified, etc.).

- Release Method: Funds may be released in installments or in full, according to the prescribed rules, directly into your settlement account.

- Reference Period (subject to notice): Based on reassessment by the risk control system, with a minimum review period of one month. If the store’s performance demonstrates lower-than-expected risk, the Risk Reserve may be released fully or partially after one month.

- After Service Termination: If you discontinue using Pisell Payments, the Risk Reserve will still be released in installments according to the agreed cycle. If chargebacks or other risks occur during the release period, the schedule may be extended or recalculated, subject to the latest notification:

- Low-risk merchants: Commonly released in batches over 3–9 months (e.g., 3 × 3 months).

- Higher-risk merchants: May be subject to longer cycles (e.g., 3 × 9 months).

- Right to Review: If you disagree with the release arrangement, you may submit a review request with supporting evidence (such as recent transaction records, reconciliations, logistics documentation, or customer complaint handling). A written response will be provided.

5. How to Reduce the Reserve Ratio or Shorten the Holding Period (Merchant Actions)

- Proactive communication: Notify us in advance of major promotions or significant business growth so that monitoring thresholds can be adjusted, helping to reduce false risk triggers.

-

Optional self-assessment: Use Risk Margin Estimation Guide (Merchant Self-Assessment Version) to estimate the likely ratio and amount, and prepare funds in advance to avoid disruptions to your settlement schedule in case a reserve is suddenly imposed.

6. Frequently Asked Questions (FAQ)

2. What is a Refund Reserve?

This section introduces the Refund Reserve, a feature that merchants can configure themselves. It sets aside a portion of your account balance (funds pending settlement) as a non-withdrawable amount, dedicated to ensuring sufficient funds are always available for refunds. This prevents situations where refunds fail due to insufficient balance at the time of processing.This feature is different from the Risk Reserve, which is imposed by the risk control system under specific conditions. The Refund Reserve is self-defined by the merchant and can be adjusted at any time, while the Risk Reserve is determined and enforced based on risk assessments and contractual terms.

1. Purpose of the Refund Reserve

- When a refund or cancellation is initiated, the system will check: Refund amount ≤ Withdrawable balance + Refund Reserve. If the condition is met, the refund will be approved, ensuring the customer receives their money back without delay.

- The reserved Refund Reserve cannot be withdrawn but is included in refund validation. When a refund is processed successfully, the Refund Reserve balance is reduced accordingly.

- For more information on the Refund Reserve, please see the full guide: Voluntary Withholding Funds.

2.How the Refund Reserve Works

- Accounting at midnight the next day (T+1): The system checks whether your Withdrawal Retention meets the required threshold.

- If it doesn’t meet the threshold: The current settlement funds will first be used to top up the “mini vault” (Withdrawal Retention) until it reaches the required level; only the remaining amount can be withdrawn.

- If it meets the threshold: The full settlement amount is released, and the Withdrawal Retention remains unchanged.

- If the mini vault was used (e.g., for refunds): The next settlement will first replenish the used portion before releasing any excess to you.

So sometimes you may see “today’s withdrawable amount decreased or even zero”—this usually means the system is topping up the mini vault first, not withholding your money.

- Target Withdrawal Retention: 200

- Day 1 Settlement: 100 → All 100 goes into the mini vault, withdrawable = 0 (mini vault = 100)

- Day 2 Settlement: 250 → First 100 tops up the mini vault to reach 200, remaining 150 is withdrawable (mini vault = 200, target reached)

- Original mini vault: 200; 80 refunded → mini vault = 120

- Next day Settlement: 50 → First 50 tops up mini vault, withdrawable = 0 (mini vault = 170)

- Following day Settlement: 80 → First 30 tops up to 200, remaining 50 withdrawable (mini vault back to target)

3. Possible impacts of not setting a Withdrawal Retention

- Refunds require a fund source: When the system processes a refund, it will first use the current settlement amount or available withdrawable balance. If that is insufficient, it will draw from the Withdrawal Retention.

- Refunds may fail if there’s no daily inflow: If no Withdrawal Retention is set or its balance is 0, and there are no new transactions on that day (e.g., after daily settlement, non-business days, very few orders), the account temporarily has no available funds, causing refunds to fail or be blocked. Common messages include “Insufficient balance.”

- Common scenarios:

- After daily settlement, there are no new transactions until the next day, but a customer requests a refund.

- Holidays or days off with no new transactions.

- At the same time, Risk Reserves must be replenished first, leaving the Withdrawal Retention insufficient to cover refunds.

3. What is the relationship between the risk margin and the withdrawal reserve?

1. Definition & Purpose

- Risk Reserve (Risk Fund, system-triggered)

- Who decides: Automatically assessed, calculated, and applied (or adjusted) by the risk control system based on the store’s actual operations.

- Purpose: Covers chargebacks, abnormal refunds, compliance risks, etc., protecting overall settlement security.

- Mandatory?: Once triggered, it is enforced per terms; if disagreed, the system may apply settlement protections (e.g., delayed settlement, limits, or suspended collections) until the risk is cleared or agreement is reached.

- Withdrawal Retention (Refund Reserve, merchant-set)

- Who decides: Set by the merchant as a portion of “non-withdrawable funds.”

- Purpose: Ensures funds are always available for refunds; the system releases refunds only if the day’s refund amount ≤ (withdrawable balance + Withdrawal Retention).

- Mandatory?: Not mandatory, but strongly recommended to maintain a safe amount to avoid situations where “withdrawable funds are used up, leaving no money for refunds.”

In short:Risk Reserve = risk buffer, decided by the system; Withdrawal Retention = refund reserve, decided by the merchant.

2. Commonality (Where the funds come from)

- Both funds come from “future settlement amounts”:

- Once the Risk Reserve is triggered, the system will prioritize topping it up from the current settlement (T+1) to reach the target.

- Once a Withdrawal Retention is set, the system will top it up during settlement to the merchant-set target.

- Only the remaining balance after topping up goes into normal settlement/withdrawable funds.

When Risk Reserve (system-triggered) and Withdrawal Retention (merchant-set) both need replenishment, the settlement allocation sequence is:

- Top up the Risk Reserve to the system-specified target at first.

- Top up the Withdrawal Retention to the merchant-set target.

- Any remaining funds are settled to the merchant.

- Risk Reserve target: 300 (currently 0); Withdrawal Retention target: 200 (currently 50)

- Current settlement: 400 → First 300 tops up Risk Reserve, remaining 100 → 100 goes to top up Withdrawal Retention (from 50 → 150), withdrawable = 0.

- Next settlement will continue topping up Withdrawal Retention to 200; only after that will funds be available for settlement.

3. Differences Between Withdrawal Retention and Risk Margin Replenishment Rules

The replenishment logic for the Risk Margin is similar to that of the Withdrawal Retention, with the main difference being the order of priority: the Risk Margin is topped up first, followed by the Withdrawal Retention. If the current invoice balance is fully used to replenish the Risk Margin, leaving no funds for the Withdrawal Retention, an adjustment for the Withdrawal Retention will be recorded and applied in the next invoice cycle.

Examples of Risk Margin Replenishment:

When a store’s Risk Margin is adjusted from 0 to 1000, the system will check the current Risk Margin during settlement. Since the store’s existing Risk Margin is 0 and the configured amount is 1000, the system will replenish the difference (settlement − 1000).

Scenario 1:

If later the Pisell platform finds the store’s transactions are normal and there are no violations, the Risk Margin is adjusted to 200. In the next settlement cycle, an adjustment is made: the period-end Risk Margin is 1000, the configured amount is 200, and the adjustment amount is settlement +800 (i.e., $800 is released to the withdrawable balance).

Scenario 2:

If later the platform identifies several abnormal transactions and needs to increase the Risk Margin to 2000, the adjustment in the next settlement will be settlement −1000.

Additional Rule:

The adjustment amount cannot exceed the available withdrawable balance. For example, if the Risk Margin needs to be topped up to 1000 but the merchant’s current withdrawable balance is only 800, the adjustment will be −800, and the remaining 200 will be carried over to the next settlement cycle for replenishment.

4. Practical Advice (A Message to Merchants)

- Risk Margin: Once the system notifies you to activate it, comply according to the terms. The money still belongs to you; it’s just used as a risk buffer and will be released when conditions are met.

- Withdrawal Retention: It’s recommended to set it at least 1.2–1.5 times your single-day highest refund amount in the past 30 days. For big promotions or pre-sales, temporarily increase it, then monitor for 7–14 days after the event before adjusting back.

- Goal: Ensure your store can always process refunds or settle compliantly at any time, without getting stuck.

751

751Family Restaurant Operation Guide - Terminal F&B System

847

847Apple Pay Platform Web Merchant Terms and Conditions

954

954Family-Friendly Restaurant User Guide (Operational Items) - Client-Side Booking for Parties and Tickets

714

714Kids Cafe Usage Guide (Operational Items) - Terminal Selling Tickets

779

779Family-Friendly Restaurant User Guide - Terminal for Booking Parties

![[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support [Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support](https://file.mypisell.com/pisel/image/435/d7d250eb99c80ca34e3e7fc75c5b92cd2025_09_26_18_07_00_009_03613999964__2880_2112__.jpeg?x-oss-process=image/format,jpg/interlace,1,image/resize,w_1080/quality,Q_90/sharpen,90) 1673

1673[Important Notice] Pisell Client Operations Team— Fixed Online Service Hours Pisell Support

2165

2165Guidelines for Estimating Reserve (Merchant Self-Assessment Version)

2047

2047Voluntary Withholding Funds & Reserve Explanation

1930

1930Voluntary Withholding Funds

2165

2165Online Payment 3DS Security Upgrade

2230

2230Kids Playground Owners Beware: Your Payment System Might Be Charging You 3x More Than You Think

4180

4180Manage Your Pisell Subscription

4062

4062Pisell Payment Chargeback FAQ

4558

4558Pisell Terminal Connecting to Cash Box

4419

4419